HELD UNDER THE PATRONAGE OF HIS EXCELLENCY DR MOUSTAFA MADBOULY, PRIME MINISTER OF THE ARAB REPUBLIC OF EGYPT

Egypt offers numerous benefits as an attractive place to invest in. One of its key advantages lies in strategic location, making it ideal gateway for businesses aiming access markets Africa and the Middle East.

Additionally, Egypt has plenty of land for development purposes and possesses significant potential harnessing solar wind energy. Moreover, the country benefits from a well-educated workforce, providing skilled labor pool industries. With a sizable domestic market, Egypt presents opportunities for businesses to establish themselves and meet local demands while also serving as central manufacturing hub both African Middle Eastern markets.

The Egyptian construction market size is expected to grow at a CAGR of 8.39% during the forecast period (2024-2029).

(Source: Motor intelligence)

Egypt has emerged as the top cement producer in Africa, with an impressive yearly production capacity of approximately 92 million tons.

(Source: State Information Services)

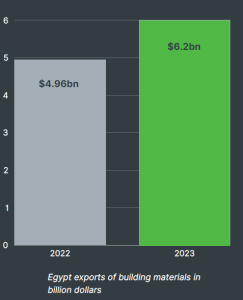

Egyptian exports to African countries totaled approximately $6 billion, marking a notable increase of around 13%.

Marble, Cement, and Polyethylene were among the leading exports from Egypt to Africa during this period.

(Source: Federation of Egyptian Industries - FEI)

Egyptian exports to African countries totaled approximately $6 billion, marking a notable increase of around 13%. Marble, cement, and polyethylene were among the leading exports from Egypt to Africa during this period.

(Source: Federation of Egyptian Industries - FEI)

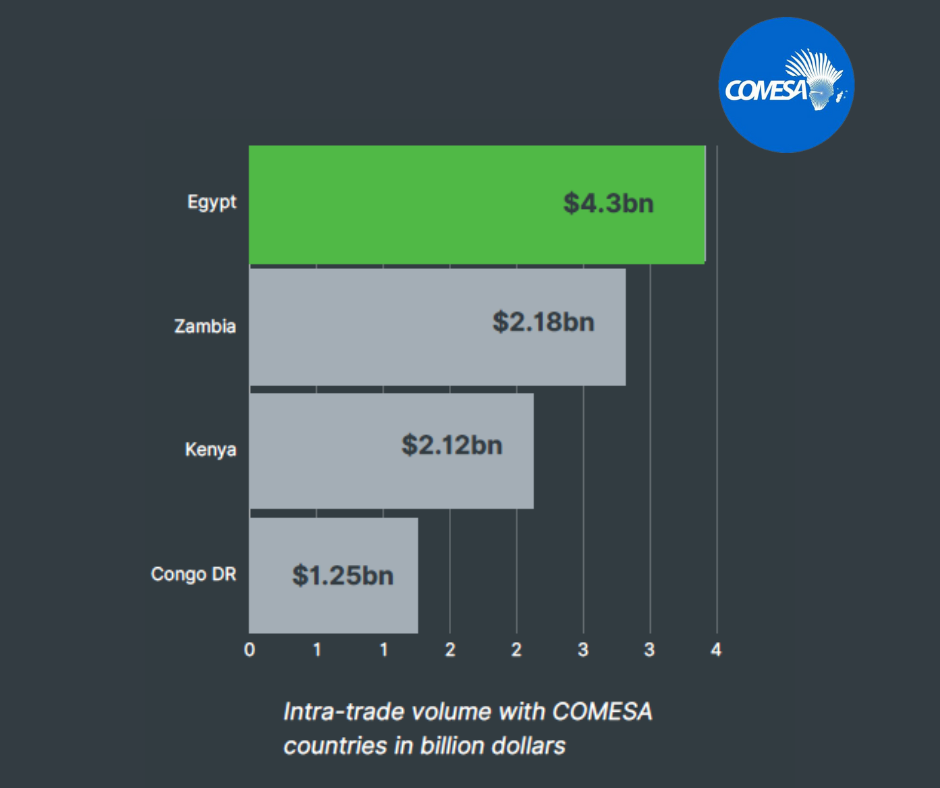

The Common Market for Eastern and Southern Africa (COMESA) consists

of 21 African Member States, encompassing a population of over 600 million people. This makes it the largest market for trade and investment.

Moreover, Egypt's participation in this regional economic blocs has further

facilitated trade and investment flows, contributing to the overall growth and development of both Egypt and its African trading partners.

Egypt holds a crucial position within COMESA, as it contributes the most

significant portion to the volume of intra-trade within the organization.

Egypt accounts for the largest share of the volume of intra-trade within

COMESA, as the volume of trade exchange between Egypt and the countries of the group reached its highest levels in 2022, reaching $4.3bn.

Egypt is one of 6 countries recently joined BRICS which is expected to streamline trade relations between Egypt and the BRICS nations.

Data from 2022 and 2023 reveals that Egypt's Trade volume with BRICS members, encompassing both funding and new members, stands at $46.673 billion. This figure constitutes over one-third of Egypt's total external trade, underscoring the significance of its economic ties with the BRICS coalition. (Source: CAMPAS)